Table of Contents

- Apple's Stock Price (AAPL) May Be Headed Toward 0

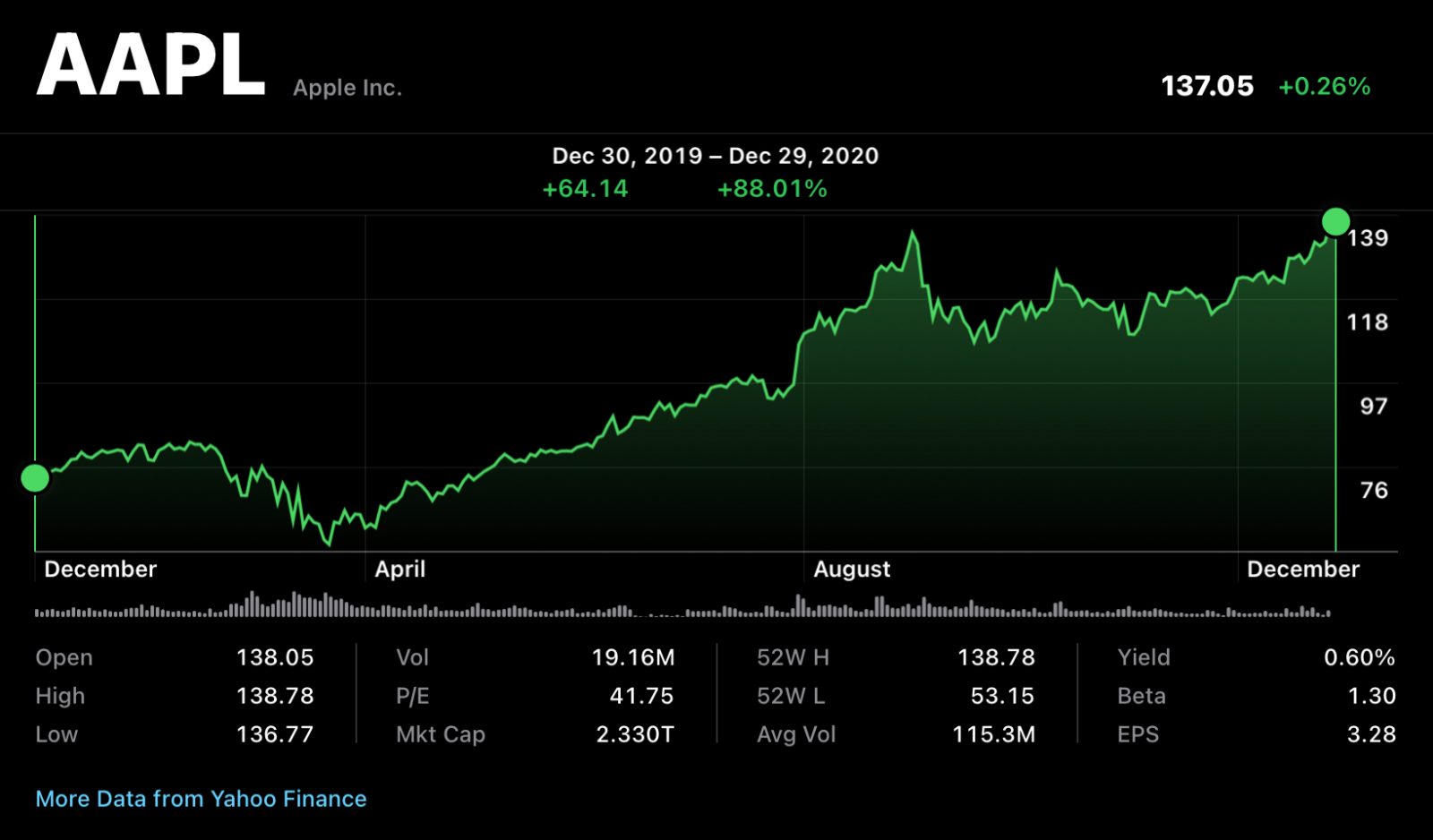

- Aapl / AAPL Stock | APPLE Stock Price Today | Markets Insider : Price ...

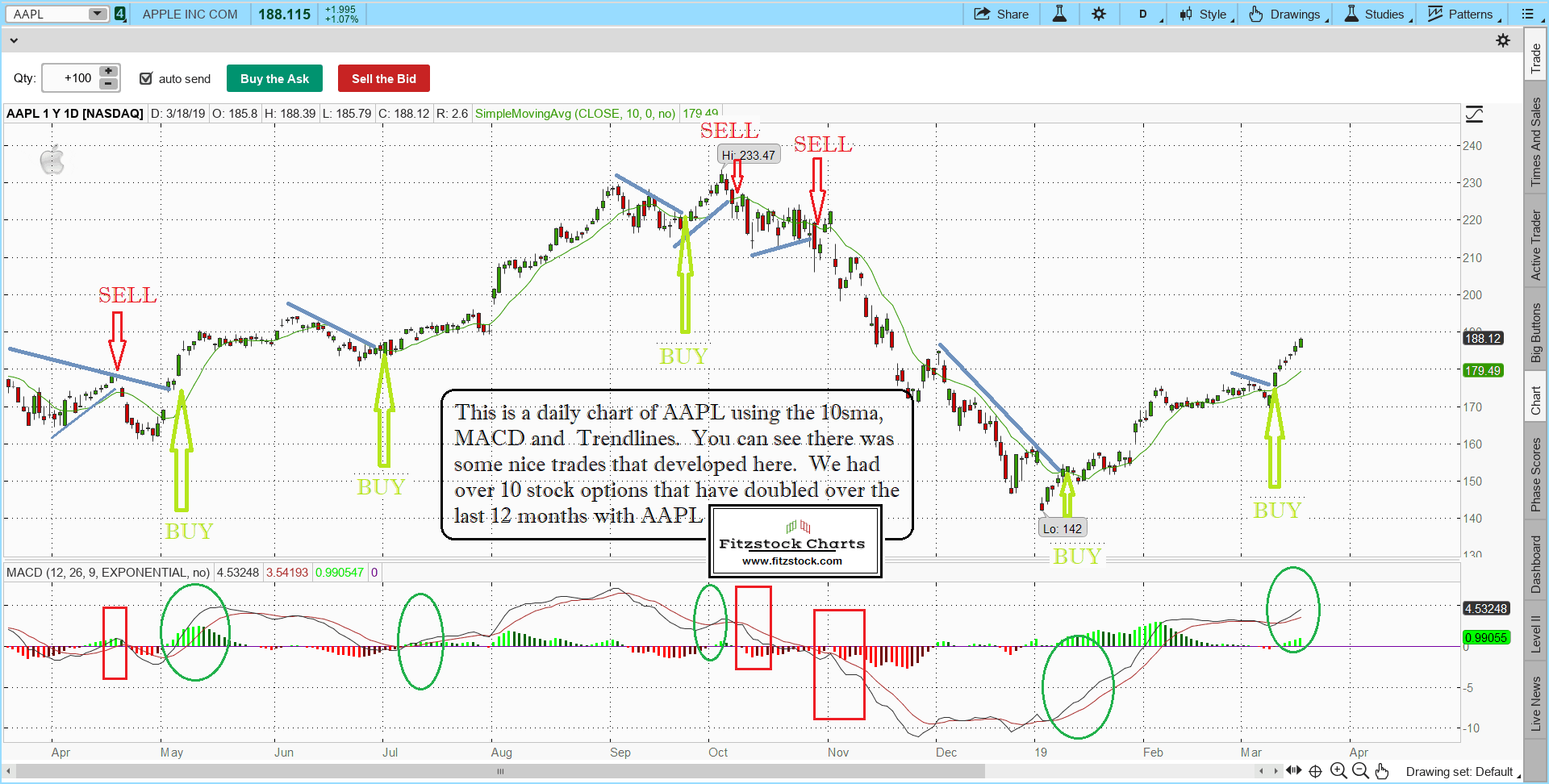

- AAPL - Fitzstock Charts

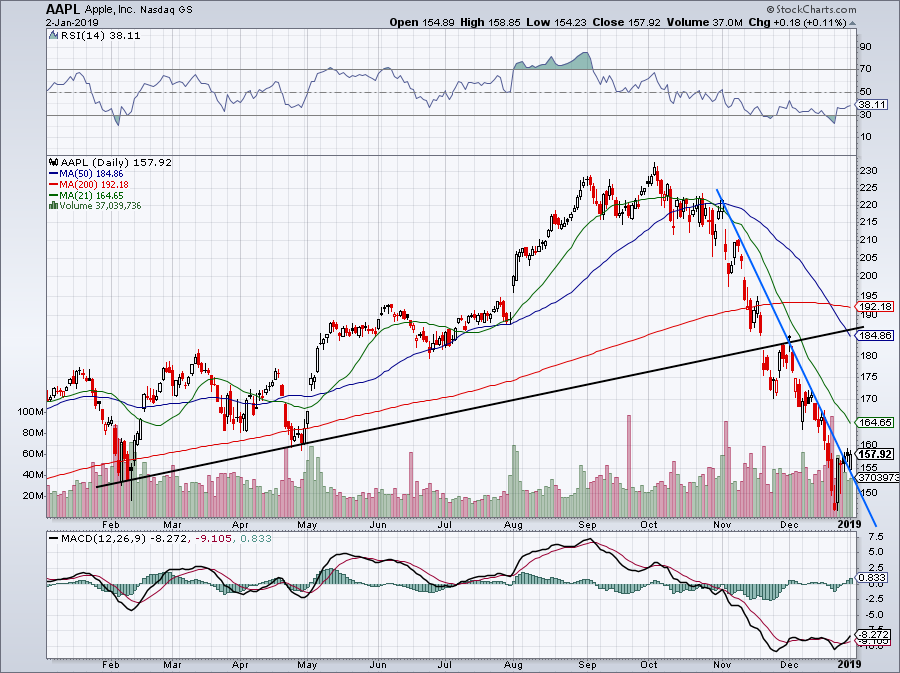

- Apple (AAPL) Technical Update - See It Market

- AAPL shares fall 3% in after-hours trading despite Q4 results close to ...

- Apple Stock: AI Growth, Record Q1, and 2025 Outlook

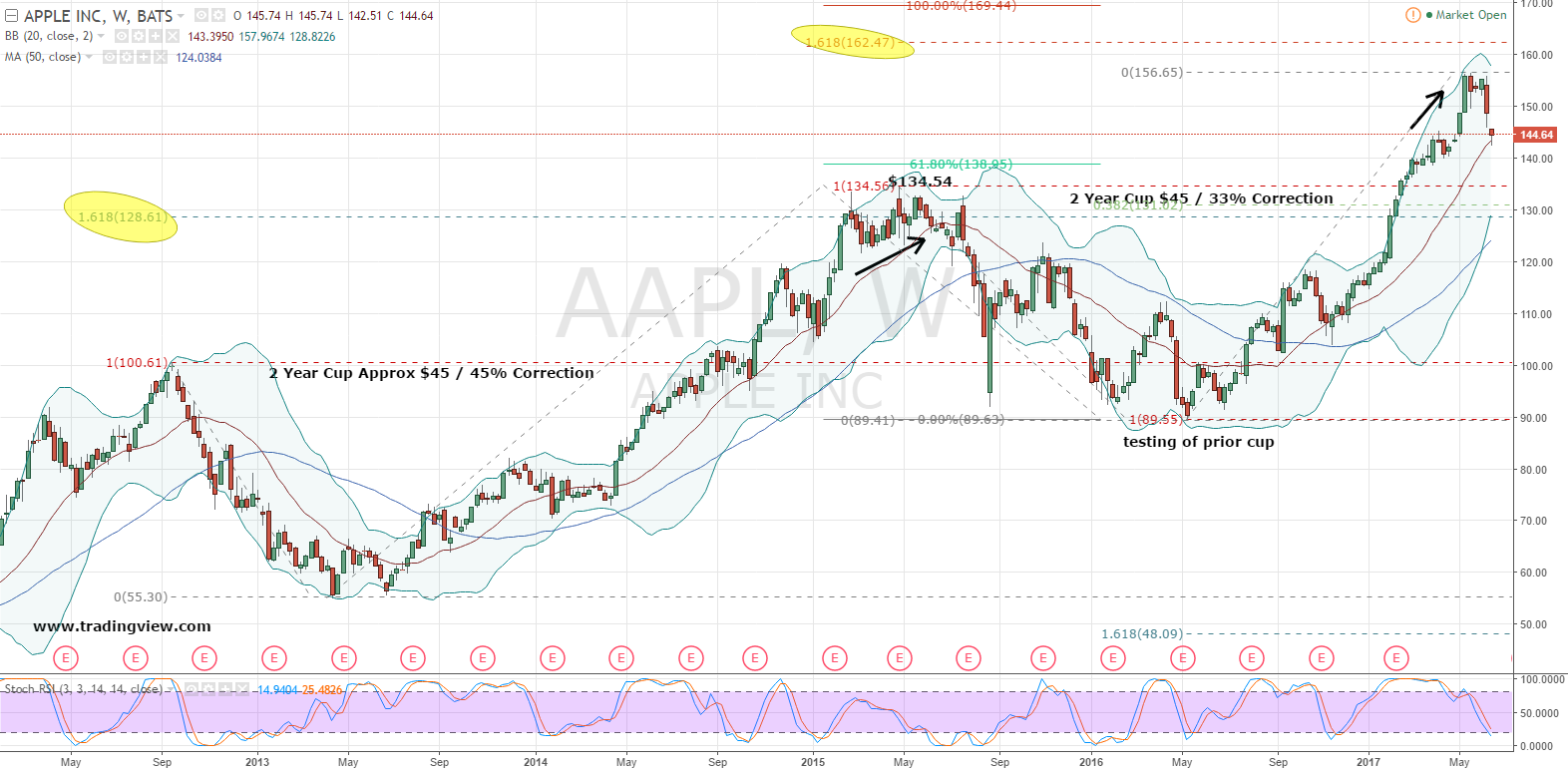

- Buy Apple Stock Once It Hits This Level

- Apple (AAPL) Stock Price Prediction 2024, 2025, 2030, 2040, 2050

- AAPL Stock: Bruised Apple Inc. (AAPL) Stock Can Still Pay You ...

- AAPL stock opens at all-time record high of 3 after Goldman Sachs ...

In recent months, Apple has been at the center of the trade dispute between the US and China, with the company's products being targeted by both countries. The US has imposed tariffs on several Chinese goods, including electronics, which has affected Apple's manufacturing and supply chain. On the other hand, China has also retaliated with its own tariffs on US goods, including Apple products. Despite these challenges, Apple has managed to navigate the situation effectively, with the company's stock price remaining relatively stable.

A Strong Earnings Report

Another factor that has contributed to Apple's resilience is the company's diversification strategy. In recent years, Apple has been focusing on diversifying its product portfolio, with a greater emphasis on services such as Apple Music, Apple TV+, and Apple Arcade. This strategy has helped to reduce the company's dependence on iPhone sales, which has been a key driver of revenue in the past. The diversification strategy has also helped to mitigate the impact of the trade tensions, as the company's services segment is less affected by tariffs and trade restrictions.

Trump's Policies Still a Threat

In conclusion, Apple stock has shown remarkable resilience amidst the global trade tensions, driven by the company's strong earnings report and diversification strategy. However, the threat of President Trump's policies still looms large, and investors are keenly watching the developments. As the trade tensions continue to evolve, it will be important for investors to keep a close eye on Apple's stock and adjust their portfolios accordingly. With its strong brand and loyal customer base, Apple is well-positioned to navigate the challenges ahead, but the company will need to remain vigilant and adaptable in order to succeed.