As a business owner in Texas, navigating the complex world of fuel taxes can be a daunting task. The International Fuel Tax Agreement (IFTA) is a crucial aspect of fuel tax management, and understanding its ins and outs is essential for ensuring compliance and avoiding costly penalties. In this article, we'll delve into the world of IFTA, its benefits, and how the Texas Comptroller of Public Accounts plays a vital role in its implementation.

What is the International Fuel Tax Agreement (IFTA)?

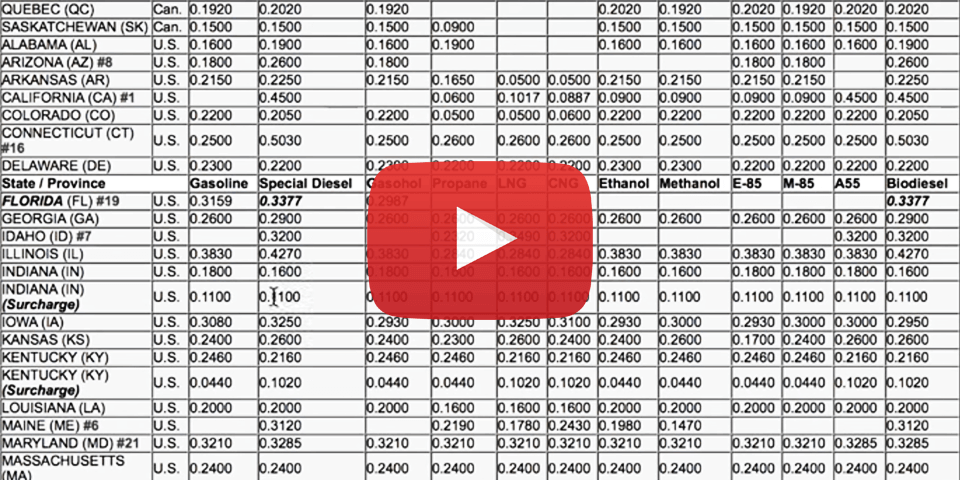

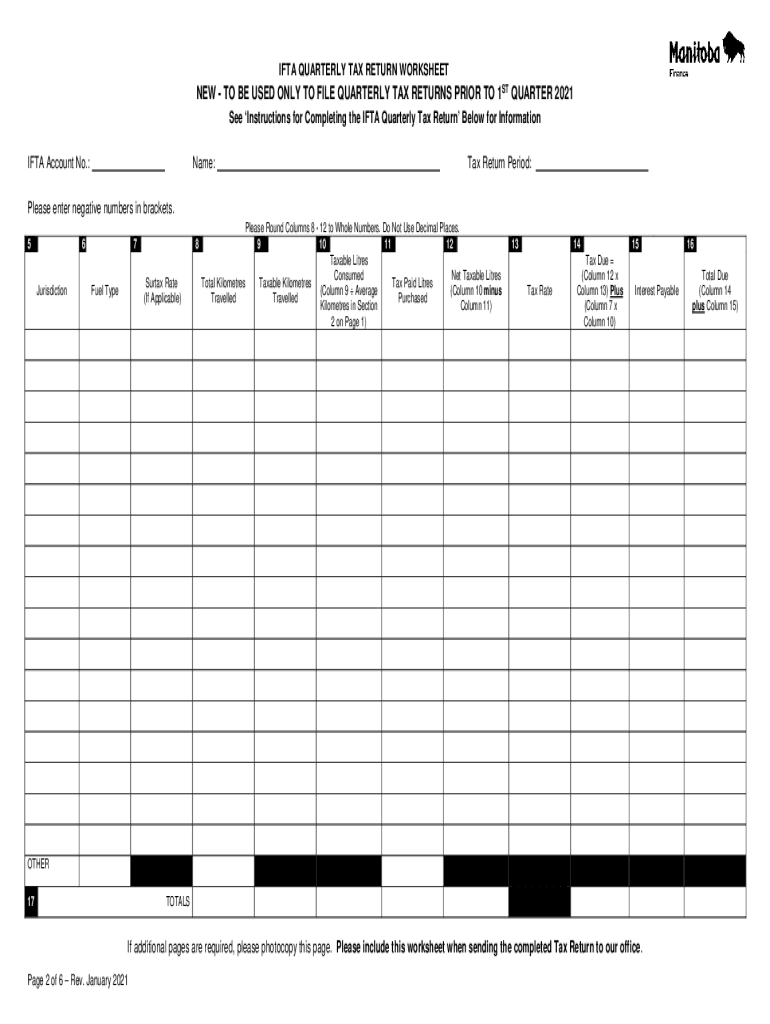

The International Fuel Tax Agreement (IFTA) is a cooperative arrangement between the United States and Canadian provinces to simplify fuel tax reporting and collection. IFTA allows businesses to report and pay fuel taxes for multiple jurisdictions through a single quarterly tax return. This agreement aims to reduce administrative burdens, increase efficiency, and promote compliance with fuel tax laws.

How Does IFTA Work in Texas?

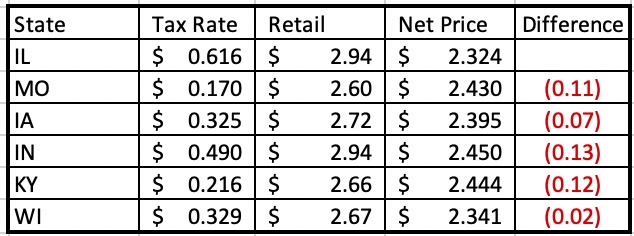

In Texas, the Comptroller of Public Accounts is responsible for administering the IFTA program. To participate in IFTA, Texas-based businesses must obtain an IFTA license and decals for their qualified motor vehicles. The license and decals are valid for a calendar year and must be renewed annually. Businesses are required to file quarterly tax returns, reporting fuel purchases and mileage for each jurisdiction traveled.

Benefits of IFTA for Texas Businesses

IFTA offers several benefits for Texas businesses, including:

Simplified Reporting: IFTA allows businesses to report fuel taxes for multiple jurisdictions through a single tax return, reducing administrative burdens and increasing efficiency.

Increased Compliance: IFTA promotes compliance with fuel tax laws, reducing the risk of penalties and fines.

Reduced Costs: By simplifying fuel tax reporting and collection, IFTA can help businesses reduce costs associated with fuel tax management.

Texas Comptroller of Public Accounts: IFTA Administration

The Texas Comptroller of Public Accounts plays a vital role in administering the IFTA program in Texas. The Comptroller's office is responsible for:

Issuing IFTA Licenses and Decals: The Comptroller's office issues IFTA licenses and decals to qualified businesses.

Processing Quarterly Tax Returns: The Comptroller's office processes quarterly tax returns, ensuring compliance with IFTA regulations.

Providing Support and Resources: The Comptroller's office provides support and resources to businesses, including online tutorials, webinars, and customer support.

In conclusion, the International Fuel Tax Agreement (IFTA) is a vital aspect of fuel tax management for Texas businesses. By understanding IFTA and its benefits, businesses can simplify fuel tax reporting, increase compliance, and reduce costs. The Texas Comptroller of Public Accounts plays a crucial role in administering the IFTA program, providing support and resources to businesses. If you're a Texas business owner, it's essential to familiarize yourself with IFTA and its requirements to ensure compliance and avoid costly penalties.

For more information on IFTA and the Texas Comptroller of Public Accounts, visit their website at

https://comptroller.texas.gov/.